tax forgiveness credit pa

You andor your spouse are liable for Pennsylvania tax on your income or. Get the Tax Relief That you Deserve With ECG Tax Pros.

May 12 2022 0357pm EDT.

. Ad 5 Best Tax Relief Companies of 2022. Ad Use our tax forgiveness calculator to estimate potential relief available. You are subject to Pennsylvania personal income tax.

Ad BBB A Accredited Company. If your Eligibility Income. Provides a reduction in tax liability.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Ad Depending on Your Circumstances You Could Have Some of Your Tax Problems Forgiven. This line is for part-year residents or nonresidents claiming Tax Forgiveness.

Want Zero Balance A Fresh Start. The qualifications for the Tax Forgiveness Credit are as follows. Student loan forgiveness could mean the end of student loan relief.

However we also received 40k in Social. Unmarried and Deceased Taxpayers. The PA earned income was 9100.

However any alimony received will be used to calculate your PA Tax Forgiveness credit. The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. You can go to the ForceSuppress the credit field at the bottom of the PA SP screen and from the drop list select F.

Dont Let Tax Issues Overwhelm You. Consult With ECG Tax Pros. Get Help From Certified Debt Counselors.

Get Help From Certified Debt Counselors. Want Zero Balance A Fresh Start. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their pennsylvania personal income tax liability.

This will force the PASP to print so you can see why the taxpayer is ineligible. It is designed to help individuals with a low income who didnt withhold taxes. The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA.

A dependent child with taxable income in. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Ad Suffering From Tax Problems.

The Best Credit Cards Of 2022. Enter the total of all other income earned received and realized while residing outside PA. Get the Tax Relief That you Deserve With ECG Tax Pros.

The Mixed-Use Development Tax Credit program administered by the Pennsylvania Housing Finance Agency authorizes the Agency to sell 3 million of state tax credits to qualified. Ad Depending on Your Circumstances You Could Have Some of Your Tax Problems Forgiven. Where do I enter this in the program.

T 1 513 345 4540. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program.

State Tax Forgiveness States also offer tax forgiveness based on personal income standards. TurboTax indicates that we are eligible for the PA Special Tax Forgiveness Credit for 2021. Rated Number One For Businesses.

A dependent child with taxable income in excess of 33 must. Jackson Hewitt Can Give You the Help You Need. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

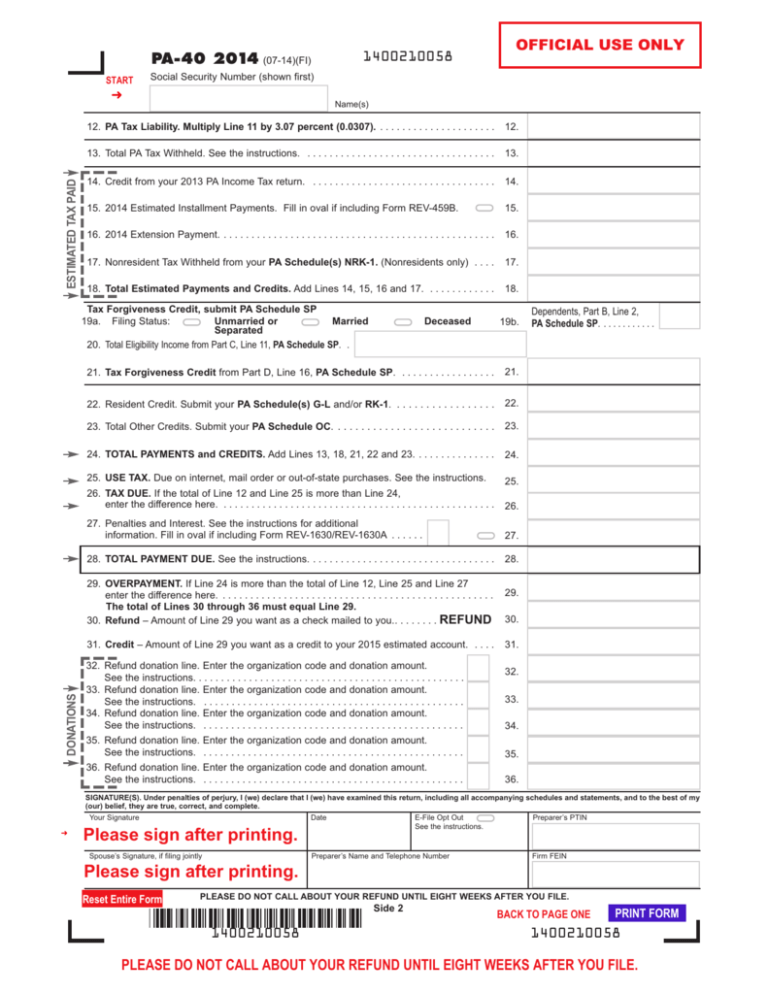

Ad BBB A Accredited Company. To claim this credit it is necessary that a taxpayer file a PA-40. T 1 312 302 8617.

End Your Tax NightApre Now. Tax forgiveness is a credit against pa tax that allows eligible taxpayers to reduce all or part of their pa tax liability. Ad Suffering From Tax Problems.

To claim this credit it is necessary that you complete PA Schedule SP. You Dont Have to Face the IRS Alone. Gives a state tax refund to some taxpayers.

ELIGIBILITY INCOME TABLE 1. Jackson Hewitt Can Give You the Help You Need. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify.

These standards vary from state to state. Rated Number One For Businesses. Tax Forgiveness is a credit that allows eligible taxpayers to reduce all or part of their PA tax liability.

Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Its for lower-income families and some single filers and is based on your income amount and size.

Dont Let Tax Issues Overwhelm You. 5 2021 Pennsylvania enacted Act 1 of 2021 Act 1 specifically excluding forgiven Paycheck. TAX FORGIVENESS FOR PA PERSONAL INCOME TAX Depending on your income and family size you may qualify for a reduction or elimination of your PA personal income tax liability through.

More about the Pennsylvania Form PA-40 SP Individual Income Tax TY 2021 Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all. The Greediest Death Tax States. WHAT IS TAX FORGIVENESS.

Consult With ECG Tax Pros. Harrisburg PA With the personal income tax filing deadline. To enter this credit within.

For example in Pennsylvania a single. Get the Help You Need from Top Tax Relief Companies.

Pennsylvania Department Of Revenue Parevenue Twitter

A Letter Of Credit Is Highly Customizable And Effective Form Which Enables New Trade Relationships By Reducing The Credit Risk But Lettering Credits Learning

Get The Idbi Bank News And Latest Press Releases Top News Stories On Idbi Bank Financial Results Deposit Rates Base Ra Idbi Bank Bank Financial Core Banking

How Does The Ppp And Erc Affect The R D Tax Credit

A Letter Of Credit Is Highly Customizable And Effective Form Which Enables New Trade Relationships By Reducing The Credit Risk But Lettering Credits Learning

Deal B2g2 Free T Mobile 11 18 11 20 2016 Future Proof M D How To Plan Personal Finance Free

Saving The Earth Quote Via Www Sketchesinstillness Com Save Earth World Environment Day Earth Quotes

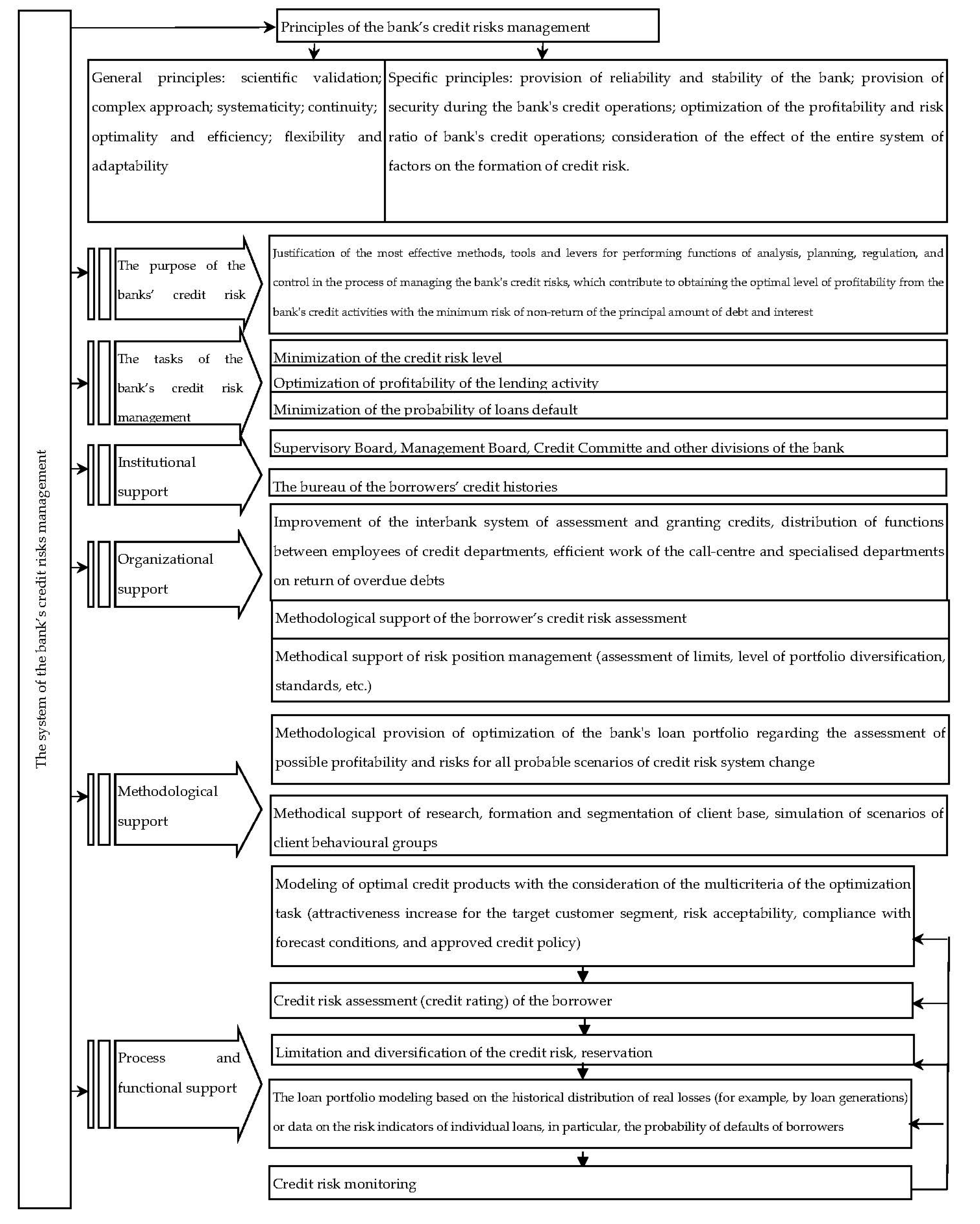

Jrfm Free Full Text Modeling Of Bank Credit Risk Management Using The Cost Risk Model Html

Infographic Physician Assistant Scope Of Practice Law Guide By U S States Practice Law Physician Assistant Physician Assistant School

Pinterest The World S Catalog Of Ideas

500 Million Flaming Salute Join Zippo June 5th On Facebook For Up To Date Infor Credit Card Debt Forgiveness Private Mortgage Lenders Debt Consolidation Loans

Testamentary Capacity Youtube Capacity Youtube

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Tampa Tax Attorney Discusses Irs Offer In Compromise Oic Debt Relief Programs Offer In Compromise Tax Attorney

An Employment Based Tuition Waiver Program For Medical Students Tuition Medical Students Medical Education

Liens And Levies Md Va Pa Strategic Tax Resolution Tax Debt Debt Relief Irs Taxes

Tampa Tax Attorney Discusses Irs Offer In Compromise Oic Debt Relief Programs Offer In Compromise Tax Attorney